The news about cryptocurrencies does not leave the headlines as they certainly contribute to the global economy. They allow removing trusted third parties from the process of validating transactions and managing the monetary policy in a new way. Just a handful of people heard of the first blockchain asset — Bitcoin — in 2009. And now, a digital asset of the millennial generation is reshaping the economy of modern society. Moving us from existing unstable banking system to the future of money where you can control your finances, enjoy security and privacy.

The field of cryptocurrencies is always expanding and more than 1,600 digital currencies already exist than Bitcoin itself. Among the most popular are Litecoin (LTC), Ethereum (ETH), Zcash (ZEC), Dash (DASH), Ripple (XRP), Bitcoin Cash (BCH). There is a need to exchange them, and that’s where crypto exchanges step up. They allow you to exchange cryptocurrencies one with another or with a national currency of your country.

The field of cryptocurrencies is always expanding and more than 1,600 digital currencies already exist than Bitcoin itself. Among the most popular are Litecoin (LTC), Ethereum (ETH), Zcash (ZEC), Dash (DASH), Ripple (XRP), Bitcoin Cash (BCH). There is a need to exchange them, and that’s where crypto exchanges step up. They allow you to exchange cryptocurrencies one with another or with a national currency of your country.

Let’s have a closer look into the existing ecosystem of the cryptocurrency trading. It will help us understand what the main entities of crypto exchanges are and how they ease the exchange and trading process.

What are Crypto Exchanges?

Crypto exchanges are online platforms which connect buyers and sellers of a particular cryptocurrency. Thus, if you want to exchange fiat money (national currency) to any cryptocurrency, or to swap one crypto into another, the crypto exchanges are the right place to go to. Trading pairs define a trade between one cryptocurrency with another or with fiat money. Basically, they allow you to profit from the currencies changing the rate. The biggest daily trading volumes today are BTC/LTC, BTC/ETH, BTC/XPR.

What are the trading regulations?

What are the trading regulations?

Now, a few crypto exchanges allow trading with fiat money as they need the special license from the regulators. The cryptocurrencies are still in their early stage of worldwide adoption as means of payment. Consequently, some of the exchange processes remain mainly unregulated. Depending on the trading volumes, you have to pass the KYC (Know Your Customer Policy). If you deal with a big quantity of currencies, you have to verify your identity. In case, the transaction with the sum not exceeding the average requires only minimal KYC (login and password) to be passed. The leading regulators from all around the world are still making efforts to develop healthier regulation. According to them, it will protect the cryptocurrency market players and leave enough space for the development of technologies.

How do Crypto Exchanges work?

Cryptocurrency exchanges were designed for traders, using the trading pairs, to profit from the currency rates. Crypto exchanges, as online platforms, match buyers and sellers of both token and coin currencies, known as matching platforms. These exchanges are not connected. People looking for buying or selling currencies specify the amount and the price they want. All these requests, known as orders, are in a common ledger, called the order book. Further, the special trading engine matches the orders one with another. If it does not locate a particular request on that order, the order stays in the order book. The order is valid until the trading engine matches it with another the suitable order. The price of the currency is a subject of a free market. Basically, buyers and sellers are those who define it.

Centralized Crypto Exchanges

Centralized crypto exchanges are companies that provide an exchange for regular traders. Above all, they act as a trusted third party meaning that you trust your funds to such platforms at your own risk. The companies, in turn, keep your money in the electronic wallets, offering you security. Using the network of users in the exchange, they provide matching platforms to find trading partners to satisfy your needs. For the exchange to be regulated, you have to pass the KYC and be completely deanonymized. It is rather simple to exchange with centralized crypto exchanges. They have advanced tools and comparatively big trading volumes and it usually takes seconds to sell/buy at them if both sides meet the mandatory conditions. There are certain disadvantages though, as you often trust your funds to unknown companies – and people behind them. Plus, there might be hacks and server downtimes which also pose a serious risk.

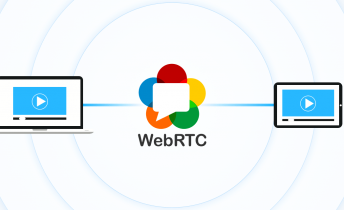

Decentralized Crypto Exchanges or ‘Peer-to-peer’ (P2P)

Peer-to-peer (P2P) or decentralized exchanges do not rely on a centralized authority to hold your funds. Instead, trades occur directly between the users according to the pre-defined automated algorithms. Latest innovations and the development of decentralized systems made this possible.

With such an approach, you can hold all the money in a personal wallet and stay in charge of your funds. In case the exchange method does not involve bank transfers, both sides of the exchange can keep their identities in secret and stay anonymous. Third parties may be involved as arbitrators but no such involvement is required by default.

Taken all together, if there is a hack or a server downtime to centralized exchanges, you could lose the funds. Meanwhile, decentralized exchanges reduce the chance to be hacked to the minimum as you keep money in personal electronic wallets.

The development of decentralized exchanges is a hot topic in crypto today. The currently existing ones have certain technical limitations with the scaling problem as a main among them. Fortunately, the best minds are working on the bleeding edge technologies will make it happen, so we are expecting it to become real soon.

IT companies are actively involved in this process developing tools and infrastructure for easier technology adoption. For instance, Right&Above has been busy with the development of various applications for the trading platform which serves over a million accounts. That, as a result, led to the trading market expansion and the advancement of its usability.

So if you are looking for a perfect company to implement your trading current wants and potential needs, we are here to help you!

The field of cryptocurrencies is always expanding and more than 1,600 digital currencies already exist than Bitcoin itself. Among the most popular are Litecoin (LTC), Ethereum (ETH), Zcash (ZEC), Dash (DASH), Ripple (XRP), Bitcoin Cash (BCH). There is a need to exchange them, and that’s where crypto exchanges step up. They allow you to exchange cryptocurrencies one with another or with a national currency of your country.

The field of cryptocurrencies is always expanding and more than 1,600 digital currencies already exist than Bitcoin itself. Among the most popular are Litecoin (LTC), Ethereum (ETH), Zcash (ZEC), Dash (DASH), Ripple (XRP), Bitcoin Cash (BCH). There is a need to exchange them, and that’s where crypto exchanges step up. They allow you to exchange cryptocurrencies one with another or with a national currency of your country. What are the trading regulations?

What are the trading regulations?